Welcome back to another edition of Rough Terrain, the newsletter about things that interest one random guy and maybe you too!

This edition’s referral is to Parcl, which will let individuals invest in high value real estate but in a way that allows you to keep your investment liquid. How do they do this? Well, something something blockchain something, of course! The product isn’t launched but the idea is extremely intriguing! I signed up and if you do too using my link, we both get to move up the wait list. We’ll talk more about this later…

Rapid Fire

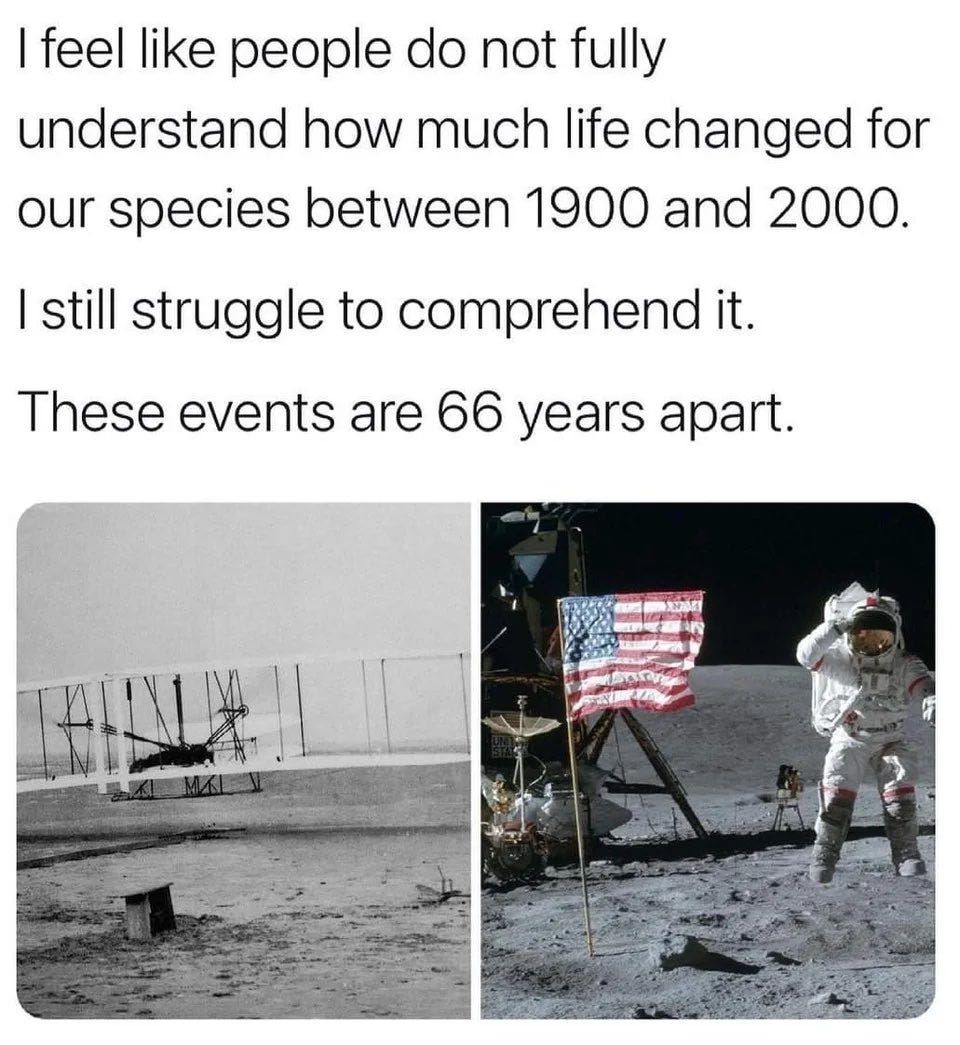

Sometimes when I get pissed about other people’s behaviors, I find this quote a helpful reminder that we’re all hopelessly outmatched by the pace of today’s world. The amount of stress generated simply by existing is enormous but most of it happens to us subconsciously. You can never go wrong by spreading more kindness, as you don’t know what others are going through. All of us are under a massive bombardment of stress our feeble lizard brains can barely handle. Life is tough, don’t make it tougher on others if you can help it.

We have Paleolithic emotions, medieval institutions and godlike technology - Edward O. Olsen

Of course, I must accompany a heavy quote like that with a meme:

Remember how I tried to buy the US constitution along with a couple thousand internet friends and how we almost did it? Well, turns out the story wasn’t over. Those of us who donated received tokens in exchange for the donation, which represented our shares of ownership over the entity that would possess the constitution. Since we didn’t win, those shares were had no purpose and so like a sane person, I exchanged them back for the original amount I had donated and went on my merry way. Except of course that this is 2021 and NOTHING IS SANE. A market for PEOPLE tokens (the name of the coin we got), which again had literally no value at that point, sprung up. For no reason besides it being funny, the PEOPLE token had monetary value. Why? Because fuck it, that’s why. At this point, what’s funny is what’s valuable in the world of crypto. Had I kept my seemingly worthless 200,000 People coins and then sold them at the peak, I would have netted $23K in profit. Balls. Memes move markets (if that’s not trademarked, I’m going to work on that).

Countless hours as a child were spent playing GoldenEye. Truly one of the greatest video games of all time. And the music track absolutely slapped, which made this TikTok clip so brilliant:

Shreyas always with the perfect advice:

My reaction to this article will be its own blog post when I summon the courage. As someone who struggles with PTSD, I appreciate how a situation like this slowly builds over years. What looks like a sudden mental breakdown is actually a long, debilitating road of torturous suffering for the soldier and his family. The author was a former commander of mine who (unintentionally) helped me decide to leave the active duty Army because I didn’t want to end up like him. This is a tough one to read but read it you must.

I bought a NFT! Mike Shinoda of the band Linkin Park sold a set of custom images paired with a music track. As a huge fan of Linkin Park in my younger years, the opportunity to participate in a continuation of their art was something I jumped at. Mike’s a technologist for sure, as each NFT and accompanying track are unique from all the others. I’m super jacked about this.

Fractionalize Everything

More and more companies are finding ways to cut up pieces of an expensive thing and allow individuals to purchase a slice. Blockchain technologies are accelerating the pace of this, as blockchains use cryptography consensus mechanisms (fancy math) to build immutable ledgers. This allows expensive assets like houses, artwork, the US Constitution, etc. to get sliced up with no dispute over validity or authenticity of the slices. Basically, math allows everyone to trust that what they bought is actually what they bought. Turns out maybe I should have paid more attention in calculus! Here’s a few of my favorites regardless of using blockchain technology or not. Not investment advice, I just think these are novel and interesting:

Masterworks. You can buy shares in famous artist’s paintings. Art has always been a speculative store of wealth but it tends to perform very different than equity markets, making it a useful tool to hedge risk in bear markets. Or so they say.

Franshares. Allows you to purchase shares in physical franchises, like gyms, restraunts, etc. Instead of having to buy the whole thing outright, which requires a ton of cash, you buy a small slice and ride the coattails of the people who actually operate it. Reading their white paper, it sounds like Franshares is actually going to run the franchises themselves so they are highly incentivized to find the best opportunities and execute them well.

The previously mentioned Parcl, which is going to (somehow) put physical real estate assets onto a blockchain which will allow for instantaneous liquidity while also tracking the assets appreciation. If you read my article about Bacon Coin, you’ll know that this is just one of many efforts to find a way to port over physical things to the world of crypto. May work, may not, but it’s great they’re trying to solve a problem with real estate investing, which is the lock up and illiquidity of the asset class.

Royal, which lets you buy fractional ownership of music. Cuts out the middle-man labels, letting musicians sell their art to their most ardent fans. All those shitty SoundCloud rappers can now finally move out of their parent’s basement!

Commonwealth. You can buy shares in racing horses! Why would you do this? Who the hell knows!

I’m excited about the fractionalization trend as it gives more people the chance to participate in forms of wealth generation otherwise out of their reach or requiring a massive investment that isn’t the smart call for most folks. The US accreditation laws cuts out a massive swath of the population using a fairly arbitrary rule based on your annual salary and/or net worth. These companies are helping people get around that antiquated (and frankly patronizing) law while also getting to participate in asset classes they otherwise wouldn’t. There’s no way I’m opening up a gym or buying a Picasso, but Franshares and Masterworks lets me buy parts of both. It’s a tool for democratizing more and more of the economy. It unlocks economic engines previously reserved for those who are were winning. I’m not a die hard free market person, but having more options is a good thing. So I’m bullish on the wave of fractionalization even if these particular companies don’t make it. Healthy markets are were lots of companies try, fail, try again, fail again, but fail better.

Granted, democratizing can be a nasty thing. We don’t really know what will happen to markets like blue chip paintings once there are 100x as many investors as there previously was. The assumptions based on the behavior of assets that were previously available to just a few are going to get challenged with the massive influx of capital and participants. Predicting future returns of assets that are suddenly fractionalized is going to tough if not outright impossible.

The wave of decentralization that is sweeping through financial asset classes is super exciting to witness. Again, not investment advice. Let me know what other fractionalization efforts you’re seeing!