Cooking with Bacon - Can a crypto startup disrupt the mortgage industry?

Schlep blindness and mullets!

This week’s referral is to Eco, The Not Bank. Eco is bringing the new decentralized financial rails getting built on crypto to consumers by serving as a middle layer much like traditional banks. But unlike traditional banks, they offer a mindblowing savings rate (up to 5%, name one bank that does that!) and they’re just getting started. Listen to this podcast with their founder to learn more. It will blow you away, trust me. Sign up and deposit $100 and we both get a boost to our savings rate. We’ll talk more about Eco in this edition of Rough Terrain!

Today is something new. Inspired by the likes of Mario Gabriele of The Generalist and Packy McCormick of Not Boring, I’m trying my hand at deep diving into a space previously unknown. I’m “red pilling” by going into the world of crypto, way deeper down the rabbit hole than I’ve gone before. I’ve highlighted some interesting web3 applications in the past, but this is the first time I spoke to founders of a crypto token, read a white paper, and struck up conversations on a discord channel. It was a lot of fun and really stoked the fires of imagination in my otherwise smooth brain. It’s also by far my longest post (4400 words!!)

In a recent episode of Modern Finance (great podcast for getting introduced to crypto), I learned of a company called LoanSnap. They are creating a crypto-based alternative for how mortgages get financed, approved, and funded. They call it Bacon (as in, bring home the bacon). The Bacon Protocol is taking out the middleman banks that fuel the mortgage industry, replacing it with a decentralized pool of funding supplied by anyone who wants to participate. It’s crowd-sourced financing for home loans, built on the blockchain.

I HATE mortgages. It’s a painful, awful system so archaic it makes me seethe. So listening to the co-founder of Bacon, Karl Jacob, explain in the podcast how it aims to revolutionize the mortgage industry, I got so excited I immediately started writing this article. All I could hear in my head was Daenerys Targaryen saying “I’m not going to stop the wheel, I’m going to break the wheel”.

I tried to write this in a beginner-friendly way. If you’re already on the crypto train, this may be too generalized. My talent is in simplifying complex topics to help larger audiences understand it. I trade precision in favor of comprehension. So if this doesn’t do a good enough job answering your questions, join the discord channels and engage with the folks at Bacon directly. Don’t @ me, I already know that I skipped a lot of details ¯\_(ツ)_/¯.

Conversely, if you’re lost after this article, here’s a pretty good resource list for understanding what crypto is. Welcome to Wonderland!

Oh, and this is NOT investment advice. I have no financial stake in Bacon or Loansnap. I just think what they’re doing is cool!

Schlep Blindness

Back in 2012, Paul Graham wrote an article on his personal blog about the idea of schlep blindness. It’s the concept that there are unpleasant tasks we all suffer through without even realizing it because the unpleasantness is unconsciously accepted.

Graham struck a note, as his article is still circulated 10 years later (a millenium in technology intellectual circles). Where there is schlep blindness, there is massive opportunity. When most people can’t even imagine a better version of a crappy task/experience, it’s possible (hard, but possible) to invent something that makes it better. And because everyone else accepts the inevitability of the task always sucking, they aren’t paying much attention to the opportunity. He cites Stripe as one such example. Before Stripe, payments was something every web company had to suffer through, building custom integrations with payment processors. Stripe came in and abstracted all that away with 7 lines of code. Suddenly something that was broadly accepted as awful, and always going to be awful, wasn’t.

Flexport was founded in part on this concept of schlep blindness. Global trade is a confusing, complicated process that its incumbents accept as the unchangeable nature of the beast. Flexport aims to change that by providing a Stripe-like layer of abstraction and simplification.

Where else is schlep blindness in effect? Mortgages.

If you haven’t bought a house, you may not be familiar with the mortgage experience. Let me share some deets. It is a fragmented and archaic industry, run mostly off of spreadsheets and relationships. It is digitally averse, as every time I’ve conducted a mortgage financing, it required a mind-numbing stack of papers that had to have wet ink signatures and a notary. What was I signing? No idea, but it took about 20-30 minutes of me and my wife signing to get through all of them.

I’ve done 3 mortgages in 2 years. Why? Because my lending rate is “locked” with each one. So if the rates go down and I want to get a new, lower rate, I have to go through the same process of stacks of paperwork getting signed. I also have to work through a mortgage agent who shops around to find me the best rate (removing my agency because I don’t have the necessary credentials to find and secure these rates myself). Once the agent finds a favorable rate, I work with them to “lock” the rate since it may change the next day. Once it's locked, me, the agent, and the mortgage company are on a short clock to get the financing completed otherwise the rate may expire.

Oh, and twice my mortgage has been sold from the original company I did the financing with to a new one. Until 2 months ago, I was with Rocket Mortgage, now I’m with some random company, Flagstar Bank. WTF is Flagstar Bank? No idea, but now they own the loan I have taken out to buy my house. I know nothing about them, their financial health, long-term plans, etc.

So yeah, mortgages suck and the industry that services them sucks. I don’t know enough about the innards of the industry to fully understand why, but I can guess a few:

Regulation: Real estate has a lot of red tape. The government plays a significant role as well as being a large lender. I’m not a libertarian by any stretch of imagination, but it’s fair to say that the larger the role the government plays in a market, the more requirements get placed on private entities participating in said market. More regulation favors incumbents.

Incumbent reluctance: The more invested companies are in the running current businesses, the less likely they are to invest in R&D that will cause innovation. There are tech disruptors (OpenHouse, Compass, etc.) but it’s capital intensive and the rest of the industry works to oppose them. They’re pitching themselves as better middlemen, not an elimination of middlemen.

Fragmented markets: Every municipality has its own set of rules. There’s likely a huge cost in expanding geographic coverage

Most of us have accepted that mortgages suck, but hey, what ya goin’ do baby? I've refinanced twice despite it being as fun as chewing glass because of the financial opportunity. Dropping a full percentage off my loan’s rate is going to save me nearly $100K over the course of my 30 year mortgage. I grit my teeth and bare it.

Now, if you’re involved with the mortgage industry, you’re up in arms over everything I said.

“Cy, you have no idea what you’re talking about. There are a number of underlying issues that make the mortgage industry complex. It may seem antiquated and silly to you, but that’s just because you’re ignorant!”

You got me. I’m ignorant, guilty as charged. As Graham states in the essay:

How do you overcome schlep blindness? Frankly, the most valuable antidote to schlep blindness is probably ignorance. Most successful founders would probably say that if they'd known when they were starting their company about the obstacles they'd have to overcome, they might never have started it.

When a marketplace is so captured by its byzantine processes and run by incumbents who are successful because of their mastery of those processes, only outsiders have the ability to fix it. Bezos didn’t know a damn thing about books but that’s what he started selling online first. The founders of AirBnb had no experience in the hospitality industry. Being inside an industry for too long and you can’t see its flaws anymore. That’s schlep blindness in action!

A business idea

Residential real estate tends to be a good investment class. It’s one of the best performing assets over time, especially in the US. Sure, there are booms and busts, like any market. But across a long time horizon, real estate does very well. Which is why so many people put money into it. Whether it’s buying a house and borrowing against it, investing in multi-tenant properties, buy shares of a REIT, or taking advantage of fractional shares of real estate the way Fundrise does, real estate is a popular way to grow your wealth.

Play along with me as I channel my inner Matt Levine:

Suppose there’s a company that takes a bunch of investments from like-minded individuals. The company’s plan is to use the pooled money from the investors to finance loans from home owners that want to borrow against their homes.

Okay, cool, sounds like pretty typical stuff, lots of companies do this. There’s good money in real estate, let’s do it!

Since other companies do this, we’ll make sure our rates are competitive. Otherwise, nobody will use our company for taking out loans and all that pooled money won’t get deployed.

Got it, okay, so that means our margins won’t be spectacular, but it’s still a good business. US residential real estate is a solid asset class, so lower margins are tolerable because those are secure loans. If anyone defaults, we’ll have a lien on their house, so we can always get a profit that way.

Actually, we want to be really competitive. Our rates will be as low as possible. Lower than any of the other companies that typically finance these loans, like banks.

Huh, okay, weird.

Oh, and we’re going to let people who take out loans from us know a ton about us. We won’t be some shadowy financial institution, reselling the loans all over the place. Owners can see exactly who gave how much money into the pool of cash that financed their house. And they can choose however long they want to pay off the loan, so long as they make the minimum payment on the loan’s interest.

Alright, sure, why not, that sounds like it could help folks feel more comfortable with our offer vs. a lot of these companies that finance mortgages.

Oh sorry, last bit - we’re going to do all of this on the blockchain and all the financing will be done with crypto coins.

Hard no

Did I have you until the last part? Don’t worry, there’s a solution and it involves bringing back the most awesome hair style ever created.

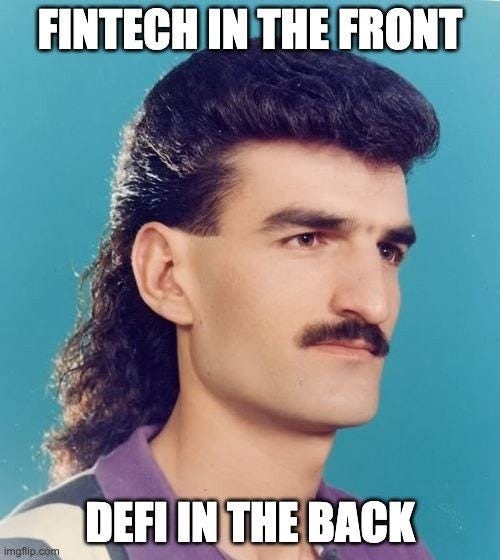

Mullets are back in style

The team over at Bankless coined the term “DeFi mullet”. It’s the concept that to drive adoption of the financial opportunities sprouting across the crypto universe (decentralized finance aka DeFi), some amount of abstraction is necessary to make things more palatable for layman users. Most folks aren’t going to get a hardware wallet, buy alt coins on exchanges, and stake those coins on decentralized apps on various blockchains for 4 digit APYs. And if I lost you on that last sentence, that proves my point. Hence the need for a DeFi mullet - business up front, a party in the back.

A good DeFi Mullet example is Eco, the “not bank” I mentioned at the top of this newsletter. They have a smooth, user-friendly interface. They actually don’t say crypto in most of their marketing material, you have to go looking for it in their FAQs. This is because most people aren’t worried about HOW Eco is able to get them a 5% savings rate and 5% back on purchases. They want those benefits and they want it with as minimal friction as possible.

I once tried to get my wife to use two credit cards. One just for purchasing gas, the other for all other purchases. The gas card had a great 5x points for purchases at gas stations. She hated the complexity, so I got rid of it. She wanted simplicity more than perks.

Yes, I know I’m sleeping on the coach for this jab at my beloved. Worth it.

Eco knows this. On the backend, Eco converts user’s deposits into a safe cryptocoin called USDC (more on this in a second) then uses those coins to take advantage of arbitrage opportunities that exist in DeFi world but not if those dollars stayed as fiat. But most Eco users don’t care about that, they just want that 5% savings rate. The fact they could probably make more than 5% if they just bought USDC and played arbitrage themselves is irrelevant. The opportunity cost isn’t worth it.

Broad adoption of crypto will likely rely on companies like Eco that adopt a DeFi Mullet strategy. They will be the companies that drive user acquisition and serve as an onramp to the “otherside”. They provide that layer of abstraction that makes it a big, fat easy button to take advantage of opportunities in crypto. This is heretical to the crypto purists, who think abstraction by a 3rd party is just another form of centralization. Over time, they may be true, but I think this approach will have tremendous value for a long time.

There’s a trend here, from Graham’s blog post to the current Mullet strategy being played out. The magic is in making a killer abstraction. Reduce the complexity and friction of participating in a market and you can dominate at least one side of that market. The companies that can be a value-add middle layer between something that is confusing (e.g. crypto, global trade, payments, mortgages) and the parties that desperately need a solution end up being the key players.

Bacon

The team at Bacon knows how to rock a mullet. They are applying the DeFi mullet strategy to the industry that in the throes of schlep blindness, residential mortgages.

Loansnap is the business up front. It looks like your standard tech-driven loan website.

Bacon is the party in the back. It looks… different

Yes, that’s really how it looks. One of the funny things about crypto culture is the intentional embracing of pixelated, low-resolution graphics. To the crypto community, this design is a signal that the Bacon Protocol is legit. To others, this is probably a huge turn off. An interesting dichotomy on how Loansnap’s website markets to a very different customer than Bacon’s website. DeFi Mullet, no?

Here’s my overly simplified break down of how Bacon works (skip if you don’t care):

Anyone who wants to participate in Bacon Protocol starts by depositing USDC (a “stable coin”, which means for every USDC coin, there’s $1 backing it) and gets bHome in return. bHome is the coin Bacon created that lets you convert the USDC to their version of a stable coin, which is a mix of US dollars and liens on houses that have taken out mortgages with Bacon. So step one is exchanging a coin that is worth exactly $1 for a coin that is worth more or less a dollar.

By owning bHome coins, you’ve got a currency that’s partially backed by US dollars, partially backed by loans on houses in the US. It’s that mix that provides the opportunity for growth. Remember how real estate is generally a good investment?

Now you’ve got bHome coins. You and everyone else who buys bHome pool your coins together so there’s one big pot. This pot is what is used to finance loans on houses. This is the supply side of the market.

The demand side is people who want to take out loans. Say you want to take out $30K, borrowing against the value of your house much like a standard refinancing. You put a lien on your house for the value of $30K, that lien is stored on the blockchain as a NFT (remember that squiggly line I mentioned a few newsletters ago?), and you get $30K of bHome in exchange. Then you go off and convert that $30K of bHome to fiat and do…. whatever the hell you want. Just pay back the monthly minimum. To decrease the risk of loan defaults (and thus protect the value of bHome), Bacon enforces the Fannie Mae and Freddie Mac Conforming Loan guidelines (example: Borrower FICO Score must be 650+).

Here are two of the live loans on Bacon:

1. $30k lien, $470k home value, 8228 Villaview Drive Citrus Heights, CA 95621

2. $100k lien, $258k home value, 9200 Madison Avenue #144 Orangevale, CA 95662

There’s a bunch of benefits to Bacon’s approach.

First, it’s extremely digital (not completely but close). There’s still some diligence needed in the physical world, which is what Loansnap and other trusted partners do as originators of the loan. They assess the value of the home before it can get borrowed against. A Deed of Trust agreement with the owner must get signed to create the lien. A record of the lien must be filed with local government. So they haven’t escaped the physical world and probably can’t unless regulations change. But it’s still a breath of fresh air from those dreaded stacks of paperwork.

Second, no bank. No mortgage agent. It’s the house’s owner, the loan originator, and Bacon. That’s it. Massive increase in agency. Cutting out the middle men means there’s less people who need to get their beaks wet. This results in lower borrowing rates. That ~3.5% mortgage rate most homeowners pay is mostly profit for the bank, as mortgages are highly secured loans against the value of the house. But if Bacon cuts out the bank by allowing all of us who have bHome be the bank for anyone who wants a loan, that 3% isn’t necessary.

Here’s the loan rates for the four houses currently using Bacon. See the $30K and $100K loans mentioned above? Their rate is 1.8-1.9%. That’s CRAZY. Think what you could do with that much cash and that low of an interest rate.

Again, NOT investment advice!

Third, no antiquated processes. If the rate to borrow changes, you no longer have to refinance your home to get more money. When rates go down, the borrower can see that their monthly payment can be lower and choose to pay off the existing loan with a new one at the lower prevailing rate. Forget that rate “lock” concept.

Fourth, Bacon is controlled by the people who fund it, not LoanSmart. It’s a DAO (decentralized autonomous organization), which is crypto’s version of a co-op.

Yes, crypto nerds, I know that is a horrific simplification of what a DAO is. Don’t “ackchyually” me, I’m trying to keep this simple.

Read here for what a DAO is. Or read this thread for Peter Yang, who nails it a comparison between a DAO and working in a tech startup

That’s either too much or too little, but that’s where I’ll call it for explaining the mechanisms of how Bacon works. If you want to keep digging yourself, check out their whitepaper or join their discord channel.

Risks

There’s a lot of risk here. Loansnap and Bacon are trying to disrupt a highly regulated, highly fragmented industry. To some, residential houses are just investment vehicles. But to folks like me, this is my forever home that I plan to raise my children in. Are they jousting at windmills? Let’s review the big hurdles they face:

Blockchain technology: Bacon is building on Ethereum, one of the most established and well-tested Layer 1 blockchains. But their coins and smart contracts are new, so there’s sure to be things needing to get smoothed out. It’s possible an attack on Bacon’s integrity could come if someone finds a glitch.

Competition - Bacon is brand spanking new. There’s 4 homes using the service. They definitely do not have a moat. I haven’t sniffed around similar products, but I’d guess if there aren’t any, there will be soon. Having some celebrity backers helps though!

Traditional industry - If you’re involved in the mortgage industry, you haven’t stopped rolling your eyes this whole time. Or you haven’t bothered reading most of this hogwash. But the hotel industry didn’t see AirBnB coming, Blockbuster didn’t see Netflix, and Borders didn’t see Amazon. Trust me, someone is coming for this industry’s lunch. I don’t think the Bacon team needs to worry about this for a long time, tbh. The mortgage industry won’t be able to grokk what the hell this is until it’s taking their lunch. I’m reminded of the saying “first they ignore you, then they laugh at you, then they fight you, then you win.”

Supply and Demand side adoption - Most of the people reading this newsletter don’t purchase crypto coins. This is all fake internet money and a giant Ponzi scheme to many people. But there are now 7 billionaires that made their wealth through crypto. So maybe it’s not such fake internet money? Bacon depends on early adopters of crypto to fund their pool of bHome. But early adopters of crypto have an enormous, expanding universe of opportunities. So they’ll have to find ways to bring home the bacon (sorry, couldn’t help myself) by incentivizing people to buy bHome. Similar problem on the other side - how do you get folks to take out a lien on their house that gets turned into a jpeg? This I’m actually less worried about because if the interest rates stay low enough, people will take the risk.

Regulatory - That giant, depressing stack of papers I had to sign when I refinanced. Is it gone? Will some random county assessor’s office come knock on my door a year from now because I refinanced my house on the blockchain but didn’t sign some form in triplicate and have it notarized? As Bacon grows in size, it’s sure to attract scrutiny. It’s happening all across crypto, as governments are starting to wake up to the massive amount of capital in this new market and realizing they better do something. Mortgages come with a lot of red tape and while it’s extremely exciting to think that Bacon can get rid of a lot of it, I’m sure some regulatory entity will flex its muscle at some point. In my mind, this is a given. So Bacon should gear up for the inevitability.

Conclusion

Crypto has done some amazing things in the short time it has existed. The fact that there’s 7 billionaires who reached the tres commas club because they own magic internet money is pretty astounding.

But so far, crypto has really only disrupted one industry, traditional finance. They’ve replicated and then improved on many of the wealth creating assets that the financial industry already had. Makes sense in a way, as everyone’s money is essentially already digital. I don’t physically receive my paycheck - my employer sends it to my bank and from the bank I parcel it out to a variety of other entities, like my credit card, my investments, and of course, my mortgage. So it’s not too big of a leap for me to say “you know what, let me put my dollars that are already digitized into a different investment that is also digitized.”

Mortgages have further to go. There’s a lot still in the physical space, which makes it tough on a team like Bacon to move it to web3. We’re dealing with large, expensive physical objects. There’s a cognitive burden on anyone who wants to try and digitize the ownership of this large physical object. Okay, so you generate a lien document on your house in the physical world, but then somehow it’s turned into a jpeg image file and now some randos on the internet hold onto that jpeg in exchange for a large amount of money? Even I, a big supporter of crypto’s efforts to disrupt existing industries, have a tough time with that.

Imagine someone coming to your house because you’re behind on a loan payment and says that because they have a low-res pixelated jpeg of your house, you have to pay up.

Lol, get wrecked internet nerd, you can fuck right off

Obviously, that last one isn’t real. Whoever services the loan is responsible for working with the borrower if they are behind on payments. But it would be hilarious

But it’s got my mind swirling. What other documents could get converted to an NFT and used to generate financing? In global trade, short term financing of inventory that is in transit from manufacturer to destination is something commonly done. The inventory that’s floating on a ship somewhere in the Atlantic is converted into capital, allowing the company importing it to not have cash locked up as inventory they can’t access. Seems like another opportunity to take an existing financial process and use the same mechanisms that Bacon is building -> Convert the physical document that represents the ownership of the goods into an NFT, fractionalize it on a blockchain and allow others to purchase those fractional shares as tokens.

I don’t know if Bacon will end up being the great disruptor of mortgages. Odds are they won’t because it’s a herculean task. But even if they specifically don’t, I think what they’re trying to do will succeed in the long run. It may be another team, another version of their approach, or something yet to be imagined. But what’s clear to me is that these middlemen are in danger. Bezos famously said “your margin is my opportunity” to which Chris Dixon added “your take rate is my opportunity” in a web3-centric update to the saying.

Middlemen are only successful so long as the value they add is accretive to the process. Where the market is ineffective and painful, they have buffer for their inefficiency and more defensibility. But as the market becomes structured and commoditized, those that intereject themselves between the supply and the demand side are at risk of being removed as an inefficiency.

Bacon is jumping on the efficiencies that blockchain technology offers combined with the enthusiasm of early crypto adopters to circumvent the traditional middlemen. They are betting that if their new method is easy enough to adopt for at least one side of the market, the significant improvements in economics they offer will pull the other side to them.

I have no idea if it will work, but I’ll be rooting for them.