Deep diving the fractional house ownership market

Hi friends, welcome back! I'm sorry it's been a while, I've been busy at work. My final article on The Quest to Define Supply Chain Visibility is mostly complete, but I guess the fact that I have to write, talk, and think about the topic every day at work tends to slow my desire to blog about it. It's coming along, I promise! Please allow me this interlude to talk about something else that strikes my fancy; I'll return to my regular posting of memes about logistics technology soon enough.

If you read my article about fractional ownership, it’s no surprise to you that the rise of tokenization of physical assets intrigues me. Setting aside the use of blockchains, which are not having a great time lately, I’m still interested in how new markets are being formed by allowing individuals to own pieces of things that they previously could only own outright. Expensive wine, art, sports memorabilia, etc. The one that is really peaking my interest in real estate. Specifically, vacation homes.

Vacations homes always fascinated me in a “are you kidding me??” kind of way. They are a monument to one’s own vanity. Got so much money you feel you need another house but instead of renting it out to others, you only visit it like 2 weeks a year and the rest of the time it remains empty? Then you need a vacation home!

Seriously, what an appalling waste of space in the most valuable and nicest parts of the world. The average 2nd home gets used 35 days a year. I can see why so many cities enact laws trying to prevent people from having unoccupied vacation houses. The lack of utility offends me.

Take for example Bend, Oregon. One of my favorite places to visit, it’s 30 minutes drive from Mt. Bachelor’s ski slopes, nestled on the banks of the Deschutes river, and has 1 brewery for every 3.2 residents (probably). It’s an outdoor adventure Mecca. It’s also home to a shit ton of high end McMansions owned by retired doctors who might visit a few weeks a year but otherwise rent on AirBnB or don’t rent at all (because who would want strangers in their vacation home?).

Before you think this article is going to get all “seize the means of production”, understand that I’m not opposed in principle to vacation homes. Got money and want to spend it on a nice big house? Good, let’s get that cash back in the economy! I’m just opposed to the current practice around vacation homes, which is to horde them like Smaug on his mountain of treasure.

So the rise of new companies who sell fractional ownership to vacation homes caught my interest. More and more people are trying to own a piece of property, but not the entire property, while still getting the perks of having a dope ass house in a cool location like Tahoe, Napa Valley, Cabo, etc. It’s an approach that may ensure the houses are actually used most of the year while also letting more people get in on the action of owning desirable real estate in hot markets.

Or so I think. Is it real?

There’s a great podcast called All the Hacks by Chris Hutchins that recently did a break down of the ways you can buy access to nice vacation homes. He covered a lot of ground, from the original time shares, to house swapping between two families, to fractional ownership. This deep dive helps serve as a further exploration of that one section of his podcast.

Fractional Ownership overview

I’m assuming if you’re reading this, you have a general understanding of how to buy a house. But the concept of buying a fraction of a house probably is bewildering.

With fractional ownership, people can purchase a portion of a property and share ownership with the others who also bought part of it. This allows them to enjoy the benefits of owning a vacation home without having to shoulder the entire cost themselves. There’s a lot of money pouring into this area:

Here, a Vacation Rental Investment Marketplace, Publicly Launches With $2 Million Pre-Seed Funding

ALTACASA RAISES €2M FOR LUXURY SECOND-HOME OWNERSHIP PLATFORM

Luxury Second Home Co-Ownership Platform Pacaso Makes UK Debut

The hypothesis of these companies is that by enabling the purchase of a slice of a vacation home, they can open up a market that historically was only available to the ultrawealthy and enable the “kinda wealthy” to also play. I say Kinda Wealthy because so far all these companies require you to be a registered accredited investor, meaning you’re making at least $200k. I’m assuming this has to do with the way the houses get split up into shares which are available to purchase, like shares of a company can be bought and sold. It’s also probably a way for them to de-risk the demand side of their market by selecting the population that has a lower credit default rate because of their income. I’m not certain if you ever know who the other buyers of the fractions are. I suppose there’s an argument to be made for anonymity but also one to be made for building a community around the shared ownership of the house.

With just 6% of US population meeting the accreditation requirements, this isn’t a big market of buyers. But it’s the folks with the most money to deploy. Since there’s a lot more folks who make that much money than the kind of people who make enough to buy a 2nd house, it makes sense. They’re expanding the addressable market 10-fold.

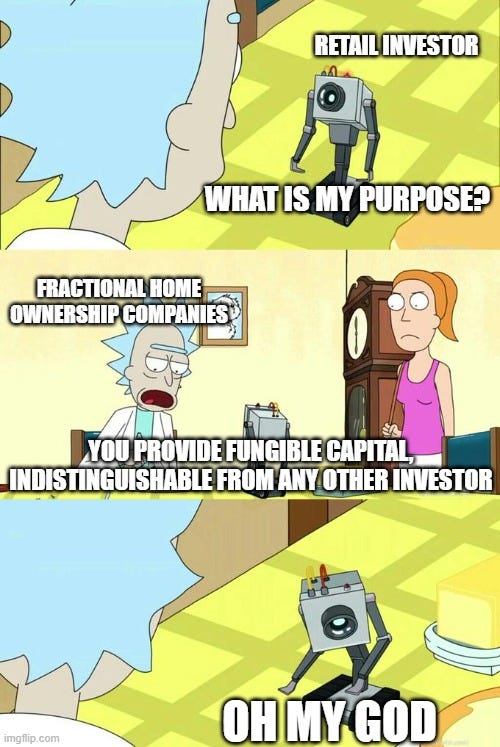

One of the attractive parts of this is these companies take care of the selection, upkeep, design, and maintenance. All you are is the capital. You pay for this convenience, as they all take a cut of the purchase, sale, and management fees along the way. Considering that for most people, purchasing an entire 2nd house themselves is out of reach and that trying to do it yourself by organizing a group of co-owners would be an enormous headache, paying these administrative costs is probably worth it. It’s just a matter of "how much” is it worth it? Would you pay 10% to not have to deal with all those issues? 15%? 25%?

Pacaso, considered the leader of this new market, charges a 12% fee of the purchase price of the home to the shareholders of the home, a monthly fee on top of any property management fees, and a 6% commission fee if you sell your share. Its competitors have rates that are roughly in-line. As more companies enter this market, I’m assuming prices for management and buying/selling fractions will go down. Whether all these cuts are worth it all depends on the value you get from the fractional ownership in terms of appreciation of the house’s value and any vacations you happen to take there.

Importantly, these companies are not timeshares. Yes, they do provide a similar service of scheduling usage of the house across all the owners. But if you have a timeshare members, you do not have any ownership of the underlying asset. You ain’t got no skin in the game. Even if you don’t ever visit the house you partially own, which would be dumb but just go with me on this, you still have the chance to come out on top by the appreciation of the house and the potential to resell your partial ownership. No such luck with timeshare memberships. Timeshare ownership is a complete fucking scam, please for the love of God don’t buy a timeshare.

Overview of companies

Pacaso - Each house Pacaso offers is set up as its own LLC. Pacaso does all the design and furnishing, as these are NICE houses. They split the house into 8 shares, with each share getting you 6 weeks per year of vacation time. There’s a fee of $99 per month on top of maintenance and upkeep costs. Importantly, you cannot rent your 6 vacation weeks on AirBNB or other short term rental marketplaces. After 12 months, you’re allowed to sell your fractional share. To attract the new tech money that is (was?) sloshing around, Pacaso offers financing and is crypto friendly. They’ve also stirred up some opposition, as Sonoma county residents are up in arms about Pacaso purchasing a number of high profile vacation houses. Locals feel this is just a way to dodge existing regulations against timeshares and short term rentals.

Kocomo - They’re basically the same as Pacaso, but they allow you to rent the weeks you get. Initially focused more on Mexico to get started, but Kocomo and Pacaso are bound to be competing against each other for marque locations. Charges 12.5% (vs. Pacaso’s 12%) and a $100 monthly fee. I didn’t find any evidence of them charging a percentage if you sell your fraction, so that’s a potential saving of 6% when (if?) you decide to exit your ownership.

Cohome - Shares start at $50k, which is a much lower price to entry than Pacaso or Kocome. I would have written more about them but most links on their website didn’t work. Probably not a great sign.

August - UK based, EU focused. Weirdly divides the houses into 21 fractions.

Fractional ownership without actual vacationing at the house

Here is similar to all the above with one key difference - ownership of shares of a house doesn’t grant you the privilege of visiting it. Instead, Here gets its group of buyers to fund the purchasing of bespoke vacation homes with the express intent of renting these places out on markets like AirBnB. As you can see in the screenshot below, Here also allows you to purchase just $1.00 of a house whereas all the other companies require 10s if not 100s of thousands to buy in since they only allow 8 or 20 fractions of houses that are worth millions.

What I like about Here is it gives you the chance to get into the short term rental business without all the hassle of buying and managing the house yourself. Is it worth the cost? That depends on (a) the rental income generated by the house and (b) the appreciation of the house when you sell your shares. For optimizing (a), Here does a lot of diligence and places smart bets on the local markets and specific houses it purchases. For (b), well, that’s just the risk with residential real estate, right? Another thing I like about Here is it lets you place a lot of bets on the appreciation of homes in specific markets because of the low cost of entry (as little as $1). I don’t know the first thing about Broken Box, OK, and will almost certainly never make it there for a vacation, but based on what I’ve read about the place, it looks quite lovely and will likely continue to grow in value. So lots of folks will visit and rent this house and lots of folks will want to buy the shares of my house (if I invested).

Thoughts

Wonky economics - There’s only so many destination locations (Cabo, Tahoe, etc.) where folks would want a vacation home. With so much money pouring into these locations (which already attract a lot of money from those rich enough to buy their own vacation house), there’s bound to be a local market bubble on house prices as these new companies compete with each other, incumbent realtors, and other buyers in bidding wars. As the supply side heats up, these companies will have to distinguish themselves. Either they have to find new markets, undiscovered houses in existing markets, or make their houses vastly more appealing than the competitors. This is all super hard and I’m doubtful any of them can build a true moat around the supply. Which means it’s a race to corner demand - which company can bring in the most buyers onto their platform and keep them there? I’m guessing that the typical buyer for fractional ownership of a vacation house isn’t someone who buys a lot of shares in a lot of houses. It’s generally a “one and done” until you’ve got enough money to buy your own 2nd home outright. Which means the Life-Time Value of a buyer is limited to the revenue they provide from a single purchase and associated fees generated off that single purchase. This will cause Pacaso, Cohome, etc. to race to capture those one-time customers, probably in the form of rebates, below-cost financing, and other efforts that will raise CAC. Oh, and because it’s so early in these companies’ lives, they have no idea if they’ve priced those fees correctly. What if the cost of upkeep far exceeds what they’ve forecasted? The winner is whomever can find the right economics on supply and demand sides to make this long-term sustainable, if it’s even possible. It’s going to be a bumpy ride! I would expect some M&A action in this new industry over the next couple years as well as big time burning of cash in the race to corner specific markets.

Index funds - Because of the rough economics, I’m predicting that the next innovation will be Index funds for vacation houses. Instead of buying a fraction of a house, you’ll be able to buy a even smaller fraction of a bunch of houses. Depending on which company offers if, you may still have visitation privileges (probably like 1-2 weeks). Here basically already provides this, they just have to build the bundle. But for someone like Pacaso, this is very much against their core premise. They want you to fall in love with the place you buy a fraction of and visit there all 6 weeks of the year you get. Oh wait, looks like someone already started doing this! Wander launched a “Vacation Rental REIT”.

Renting - Eventually, all these places will allow renting. It’s just not sustainable for folks who only buy a fraction of a vacation home so they can only visit 6 weeks a year (and which 6 weeks??? That matters a LOT. Nobody wants to spend 6 weeks in Tahoe in May, you want summer or winter seasons). I get that they’re trying to preserve the allure and exclusivity of the houses, but you’re cutting off a big potential revenue stream. I don’t see it working out. Which then begs the question, who do you partner with to rent? Build your own platform to cut out the middle man like AirBnB and VRBO? Or take the easy path but give up 20-30% of the top line?

Got any thoughts of your own about fractional ownership of vacation rentals? Share them in the comments section below! I’m going to toss a few bucks at a fancy house in Oxbow, OK!

Rapid Fire

stuff from around the interwebz I’ve enjoyed:

I’m having a blast with all the new generative art AI models like Stable Diffusion. Here’s a select few I made of my kids:

Art is just the starting point for the new AI models though. I think we’ve got a lot of jobs that are about to get disrupted as models that enable “text to code” get productized. Better watch out!