There's a revolution in wealth management right now and all I've got is a f&*^king Excel file

Traditional investment advisors are failing to keep up with the radical changes happening

Welcome back to all 19 of you beautiful people who graced me with your subscription. I’m honored, truly. I don’t know if I have much worth saying, but I appreciate the vote of confidence you’ve given me in what I’ve said so far!

And if you aren’t one of those 19 incredible human beings, perhaps you’ll decide to join them and smash that subscribe button below?

The world of wealth management is going through a massive upheaval right now. Whether you know it or not, the battlelines are shifting as new asset classes (e.g. crypto) are getting adopted while others previously available to just the ultra wealthy (e.g. art, wine, private equity) are getting democratized. The paradigm of “60% public equity, 40% bonds” that we’ve all followed is getting blown up. The changes are happening so fast that it’s breaking institutions and systems we’ve relied on for decades. That includes the products and services we’re accustomed to using to manage our personal wealth. They can’t keep up and many don’t want to. A void is forming between the old ways and the new, where there is tremendous opportunity but very little help and guidance.

That was a hell of a opening paragraph. Best you let that marinate for a minute.

I know this sounds inflammatory and all hype. But I fired my fiduciary last week because they were unable to keep up and couldn’t give me the advice I needed. I now track my net worth on an Excel file because it’s the only suitable solution.

A f*&^ing Excel file. It’s 2021, and that’s the best thing available.

You may not believe me. But I believe me, and I’m putting my money where my mouth is.

A lot of smart people are documenting this revolution in real time. I am just an active watcher, so I encourage you to go educate yourself. Packy McCormick of Not Boring is my go-to thinkboi for these sorts of things. Here are a few choice articles of his that are capturing the zeitgeist (is that the right word? Idk, sounds good).

Let me summarize what’s going on.

Disclaimer - I’m including some referral links to the products I believe in and am actively using to manage/increase my wealth. I’ll never refer you to things that I don’t have significant skin in the game on and always call out that it’s a referral. Look for italicized notes that indicate as such. If you find it helpful and use the company’s product, we’ll both win!

One thought - many of the disruptive and innovative companies I link to have sweet deals for their early adopters. Even if you’re not sure you’ll use them, signing up can secure privileges that won’t be available when the product is broadly adopted. Early bird get the worm!

Democratizing existing asset classes

You can now buy fractional shares of great artists by using MasterWorks. Their online platform allows you to invest in world renowned painters, who’s work will later sell at a higher price (or at least that’s the plan). I’ve bought myself a tiny slice of a Jean-Michel Basquiat. You no longer have to wear a top hat and a monocle to buy art, and can use it as an excellent de-risker to your portfolio if you're public equity heavy. If you want to skip the wait line with MasterWorks, let me know, I can refer you.

I own like 0.0042% of this beauty

If you check out Rally Road or StockX, you can see antique cars, comic books, sneakers and all sorts of expensive collectibles. Transactional markets are getting built where previously you had to “know a guy” and drop massive amounts of cash for these sorts of things. You can now own a fraction of a Babe Ruth rookie card and profit from when its resold.

Real estate platforms like Fundrise are cutting out the middlemen, allowing investors to buy into individual developments instead of REITs which take a big slice of the profit.

Carta and Forge are building marketplaces where you can buy shares of private companies before they list on public markets. You can buy into the hottest tech companies (cough...Flexport….cough) BEFORE they go public, potentially getting a significant discount on the stock price.

Titan is bringing investment strategies of the ultra wealthy to the individual retail investor with a fraction of the asset management fees. They’re also building one of the first actively managed crypto funds. I’m super bullish on Titan and am moving some of my public equity to them as well as buying into their crypto fund. Click here for a referral link that will scratch my back and yours if you open an account.

New asset classes

Crypto. I’ve gone from “lol, internet money” to “oh shit, DAOs will upend the current venture capital model by shifting power to the decentralized communities that best organize themselves and engage with builders, making all but the most valuable LPs unnecessary” in about 2 months. I’m moving a portion of my wealth into crypto via Titan as well as doing my own individual investing efforts. A part of me is still in the “lol, internet money” phase, but there’s a lot of billionaires who made their money by buying that internet money, so I’m laughing less about it than I used to.

NFTs. If you haven’t noticed that JPEGs are getting sold for millions of dollars, then let me blow your mind for a second. Non-Fungible Tokens (NFTs) are a new way for the creative class to capture a much greater percent of the value generated by their work and reclaim agency. The market for NFTs is HOT and there’s sure to be some boom/bust cycles. But the opportunity to buy and sell art with a click of a button is enticing and some folks are stacking straight CASH by making colorful squiggly lines.

Yes, you read the correctly. Three quarters of a million dollar for a colorful squiggly line. As Nikhil rightly asks myself:

Reinventing asset classes

An interesting use case is how crypto is getting used to make new versions of existing financial systems and tools. Take Eco for example. It’s a “not bank” that is able to offer its users a 5% APR savings account and 5% cash back on purchases (!!!) by building their infrastructure on stablecoins. That’s crazy. My current bank doesn’t provide either of those features, that’s more like what my credit card does (except Eco doesn’t do the whole annual fee or 19.99% interest rate thing to get their pound of flesh). I’m moving a good bit of my monthly cash flow over to Eco as a result, as this gives me a marked advantage in accumulating wealth vs. traditional checking/savings accounts. This referral lets you skip the waitlist and increases my APR for each person who joins. Get that money, son.

My old boss (technically, my old boss’s boss’s boss’s boss’s boss) famously said “your margin in my opportunity”. The next evolution is “your take rate is my opportunity”. Eco is a prime example of this happening in real time. Traditional banks can’t provide that level of savings rate or cash back, they are structurally incapable of such a thing and heavily incentivized to not try. To the victor goes the spoils.

The Times, They Are A Changin’

Lots of changes, huh? Hard to keep track of, let alone have an informed opinion on. And this is money we’re talking about, we’re playing for keeps. The FOMO is strong because there’s so much capital getting thrown around and you hear about some weeb who makes a killing in an alternative ETH coin. If you’re like me, you started to ask yourself what you are missing out on. Why not me?

It’s exhausting trying to keep up. That’s why many folks don’t bother. It’s not like “immutable blockchain” or “Reg A+” are issues 99.99% of us deal with on a daily basis. Why expend the cognitive load necessary to understand?

So what do most of us do instead? Look for experts. Look for intermediaries to tell us what to do. People we can trust to take care of it all for us.

You know, like the fiduciary I just fired.

I had to let them go because they were fundamentally misaligned. All their assets under management were in traditional classes. Their incentives were to maintain the status quo. Their idea of “aggressive investment” was small cap stocks. They had no informed opinion of any of the asset classes I listed above. Trying to chat about investing in art or crypto was like trying to discuss the health benefits of garlic with a vampire.

When I sat back and considered just how many new ways to build wealth are becoming available to the individual retail investors, how many of them have very different profiles than public equity, and how much potential these assets have to rapidly increase my wealth so I don’t have to work until I’m in my 60s, I knew it was time to change.

The issue I (and you if you start down this rabbit hole) now face is how to manage it all. I’ve got all my standard public equity (Vanguard, Fidelity, etc.). But I also have crypto, art, angel investing, real estate, collectibles, private equity, and other shit I’ve probably lost track of.

Until just a few months ago, products like Personal Capital worked. I used them to plug into every bank I had, serving as a single pane of glass for my wealth. That was cool until suddenly I had new asset classes that don’t mesh well with others. You can manually enter other investments into their dashboard if you want, but it’s a hassle. Plus, it makes me nervous to have so much financial data in the hands of a company that has its own investment vehicles that they try very hard to sell you on (the downside to their “free” software).

Crypto values change every second, akin to stocks (except it is 24/7/365 instead of Mon-Friday during trading hours). Art and angel investing don’t move much. Different assets call for different solutions.

Software products are struggling to keep up to this new wave of wealth management and their incentives aren’t aligned because they want us to buy services from them they’ve spent so much time building.

All Roads Lead to Excel

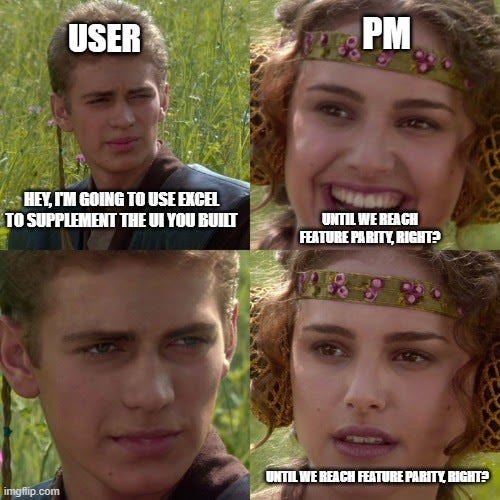

And what do we do when digital products fail to provide the functionality we need?

We revert back to Excel. The bane of every product manager’s existence and the God King of software. Near infinite modularity, with entire businesses run off it. It’s the world’s most common programming language. Even at mighty Amazon, VPs run their business reviews centered around Excel files. I often joke that the job of a product manager is to make software that is just good enough to get people to stop using Excel. I’d love it if I didn’t hate how damn useful it was.

Unsurprisingly, Packy has written about Excel as well (I know, I’m a fanboy, what can I say, the dude gets it).

I found an okay-ish dashboard in a Discord server that I now use to watch all the asset classes I have money in. It’s not great but it works for the moment.

I’m sure there will be solutions soon enough to solve this problem. Exirio seems to be working on it. Personal Capital will surely adjust.

But there’s still a gaping hole. There’s no trusted intermediaries anymore. If the classic 60/40 split is dying, what replaces it? I’m a 36 year old who’s trying to understand exactly how much I should invest in each of these new asset classes. Is it 50% stock, 50% everything else? How much of that 50% should be angel investing if my investment goal is to retire by 55? Just how counter-cyclical is crypto and fractional shares of art?

In traditional wealth advising, they had answers for what goes into the 60/40 split, depending on your goals and risk tolerance. This was all built on the back of decades of in-the-trenches experience by the banks and financial institutions. But only companies like family offices of the ultra wealthy have had persistent exposure to most of these alternative asset classes that are democratizing. Nobody has been managing crypto investments for decades, or even years. It’s total blue ocean and we’re all learning how to swim.

Excel is a symptom of a bigger problem. It’s what we revert to when products and services aren’t meeting our needs. It’s our safety net, the fallback when all else fails. I’m confident companies will build better solutions to solve the single pane of glass problem for wealth management of all asset classes. But I think it will be a harder slog for someone to solve the real problem of being able to match an individual investor’s unique circumstances with a strategy that balances appropriately across the ever-increasing number of asset classes.

As they say, the future is already here, it’s just not evenly distributed. The race is on to build the next generation of advisors that can help the 99.99% of us who can’t keep up with the pace of financial revolution and are at risk of getting left behind as we happily plod along with our 60/40 split.

Because the change is not going to slow down, it’s going to speed UP. We’re witnessing the beginning of exponential growth in the ways people will generate wealth. This has been a long time coming, the result of the compounding effect of decades of investment in systems built on top of systems. It’s breathtaking and terrifying.

My advice - keep an eye on Titan, Equi, Eco, and others who are built on the new financial rails. Dip a toe in now so it’s easier to jump in later. This problem is getting worked on by upstarts and innovators, not the incumbents.

Until they’re read, I’ll head back to my Excel file.

Like what you read? Subscribe to Rough Terrain so I can keep dazzling with my brilliance.

And if my newsletter isn’t enough Cy for ya, you should

Please, it’s cold and there are wolves and I’m so lonely and nobody laughs at my awesome memes.

On behalf of the Exirio team, thank you for finding our app promising. We keep working hard to solve all the issues you mention.